According to this model the net cash flow is completely stochastic. When changes in cash balance occur randomly, the application of control theory serves a useful purpose.

The Miller Orr model is one of such control limit models. This model is designed to determine the time and size of transfers between an investment account and cash account. In this model control limits are set for cash balances.

These limits may consist of h as upper limit, z as the return point and zero as the lower limit.

When the cash balance reaches the upper limit, the transfer of cash equal to h, z is invested in marketable securities account. When it touches the lower limit, a transfer from marketable securities account to cash account is made.

During the period when cash balance stays between (h, z) and (z, 0) i.e. high and low limits, no transactions between cash and marketable securities account is made. The high and low limits of cash balance are set up on the basis of fixed cost associated with the securities transaction, the opportunities cost of holding cash and degree of likely fluctuations in cash balances.

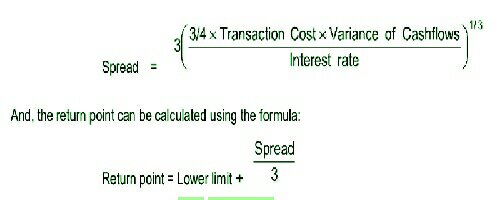

These limits satisfy the demands for cash at the lowest possible total costs. The formula for calculation of the spread between the control limits is:

Baumols Model of Cash Management

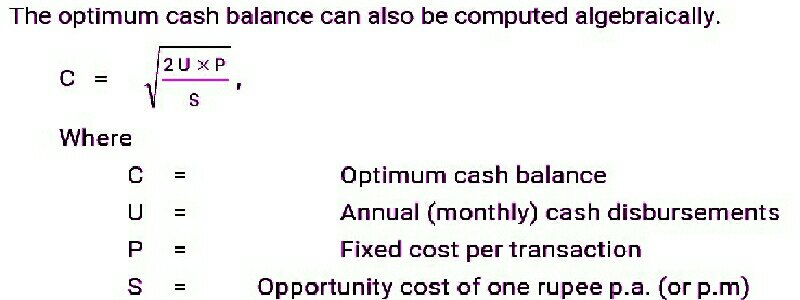

William J. Baumol developed a model for optimum cash balance which is normally used in inventory management.

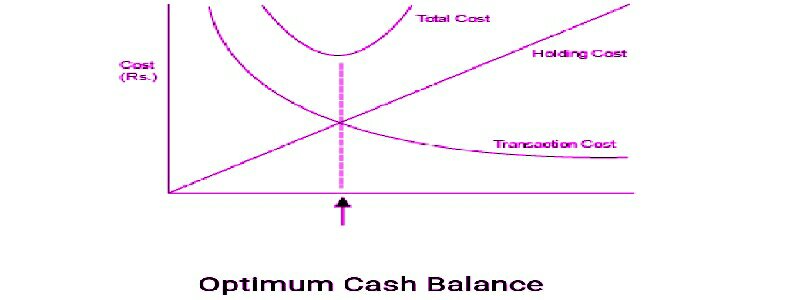

The optimum cash balance is the trade-off between cost of holding cash (opportunity cost of cash held) and the transaction cost (i.e. cost of converting marketable securities in to cash).

Optimum cash balance is reached at a point where the two opposing costs are equal and where the total cost is minimum.

This can be explained with the following diagram:

The model is based on the following assumptions:

- Cash needs of the firm are known with certainty.

- The cash is used uniformly over a period of time and it is also known with certainty.

- The holding cost is known and it is constant.

- The transaction cost also remains constant.

Now-a-days, electronic delivery and payment system are becoming increasingly important because of increased competition and the demand for more efficient and convenient capabilities.

(i) Electronic Fund Transfer: With the developments which took place in the Information technology, the present banking system is switching over to the computerization of banks branches to offer efficient banking services and cash management services to their customers. The network will be linked to the different branches, banks. This will help the customers in the following ways:

♦ Instant updation of accounts.

♦ The quick transfer of funds.

♦ Instant information about foreign exchange rates.

(ii) Zero Balance Account: For efficient cash management some firms employ an extensive policy of substituting marketable securities for cash by the use of zero balance accounts. Every day the firm totals the cheques presented for payment against the account. The firm transfers the balance amount of cash in the account if any, for buying marketable securities. In case of shortage of cash the firm sells the marketable securities.

(iii) Money Market Operations: One of the tasks of treasury function of larger companies is the investment of surplus funds in the money market. The chief characteristic of money market banking is one of size. Banks obtain funds by competing in the money market for the deposits by the companies, public authorities, High Net worth Investors (HNI), and other banks. Deposits are made for specific periods ranging from overnight to one year. The rates can fluctuate quite dramatically, especially for the shorter-term deposits. Surplus funds can thus be invested in money market easily.

(iv) Petty Cash Imprest System: For better control on cash, generally the companies use petty cash imprest system wherein the day-to-day petty expenses are estimated taking into account past experience and future needs and generally a week’s requirement of cash will be kept separate for making petty expenses. Again, the next week will commence with the predetermined balance. This will reduce the strain of the management in managing petty cash expenses and help in managing cash efficiently.

(v) Management of Temporary Cash Surplus

Temporary cash surpluses can be profitably invested in the following:

♦ Short-term deposits in Banks and financial institutions.

♦ Short-term debt market instruments.

♦ Long-term debt instruments.

♦ Shares of Blue chip listed companies.

(vi) Electronic Cash Management System: Electronically, transfer of data as well as funds play a key role in any cash management system. Various elements in the process of cash management are linked through a satellite. Certain networked cash management system may also provide a very limited access to third parties like parties having very regular dealings of receipts and payments with the company etc. A finance company accepting deposits from public through sub-brokers may give a limited access to sub-brokers to verify the collections made through him for determination of his commission among other things.

Benefits: Good cash management is a conscious process of knowing:

♦ When, where and how a company’s cash needs will arise.

♦ Knowing what are the best sources of meeting at a short notice additional cash requirement.

♦ Maintaining good and cordial relations with bankers and other creditors.

Scientific cash management results in:

♦ Significant saving in time.

♦ Decrease in interest costs.

♦ Less paperwork.

♦ Greater accounting accuracy.

♦ More control over time and funds.

♦ Supports electronic payments.

♦ Faster transfer of funds from one location to another, where required.

♦ Speedy conversion of various instruments into cash.

Even a multinational organization having subsidiaries worldwide, can pool everything internationally so that the company offset the debts with the surplus monies from various subsidiaries.

The ultimate purpose of scientific cash management is to ensure solvency, liquidity and profitability of the organization as a whole.

(vii) Virtual Banking: Broadly virtual banking denotes the provision of banking and related services through extensive use of information technology without direct recourse to the bank by the customer. The origin of virtual banking in the developed countries can be traced back to the seventies with the installation of Automated Teller Machines (ATMs). Subsequently, driven by the competitive market environment as well as various technological and customer pressures, other types of virtual banking services have grown in prominence throughout the world.

Significant Developments:

Following are some of the significant developments:

♦ Introduction of computerized settlement of clearing transactions

♦ Use of Magnetic Ink Character Recognition (MICR) technology

♦ Provision of inter-city clearing facilities and high value clearing facilities

♦ Electronic Clearing Service Scheme (ECSS)

♦ Electronic Funds Transfer (EFT) scheme

♦ Centralised Funds Management System (CFMS)

♦ Securities Services System (SSS)

♦ Real Time Gross Settlement System (RTGS)

Advantages

The advantages of virtual banking services are as follows:

♦ Lower cost of handling a transaction.

♦ The increased speed of response to customer requirements.

♦ The lower cost of operating branch network along with reduced staff costs leads to cost efficiency.

♦ Virtual banking allows the possibility of improved and a range of services being made available to the customer rapidly, accurately and at his convenience.

Thanks for sharing such a useful and informative post like this. Keep updating more updates like this.

ReplyDeleteBest Sub Brokership

wonderful info. hope it wioll be useful for me. thanks

ReplyDeletelowest brokerage